Headcorn Baptist Church receives no central funding and is financially self-sustaining. Everything here is paid for by members of our congregation, income from hiring out the halls and other gifts. At Headcorn Baptist you’ll find a group of committed people who give money and time to ensure that there is a Minister and that the work of the church is done. If you would like to support us you can contribute to our work at our giving page -https://pay.sumup.com/b2c/Q6E4LMLR or by clicking the button.

Headcorn Baptist Church receives no central funding and is financially self-sustaining. Everything here is paid for by members of our congregation, income from hiring out the halls and other gifts. At Headcorn Baptist you’ll find a group of committed people who give money and time to ensure that there is a Minister and that the work of the church is done. If you would like to support us you can contribute to our work at our giving page -https://pay.sumup.com/b2c/Q6E4LMLR or by clicking the button.

Giving

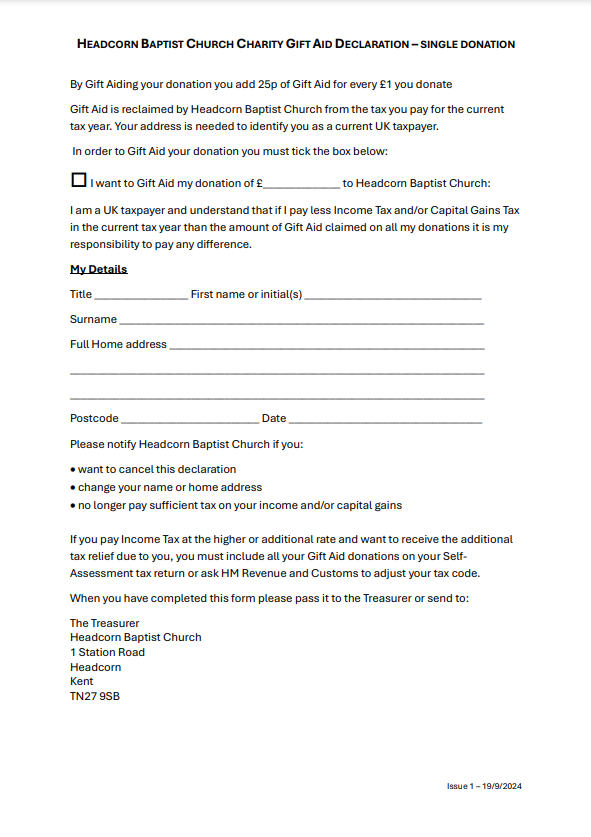

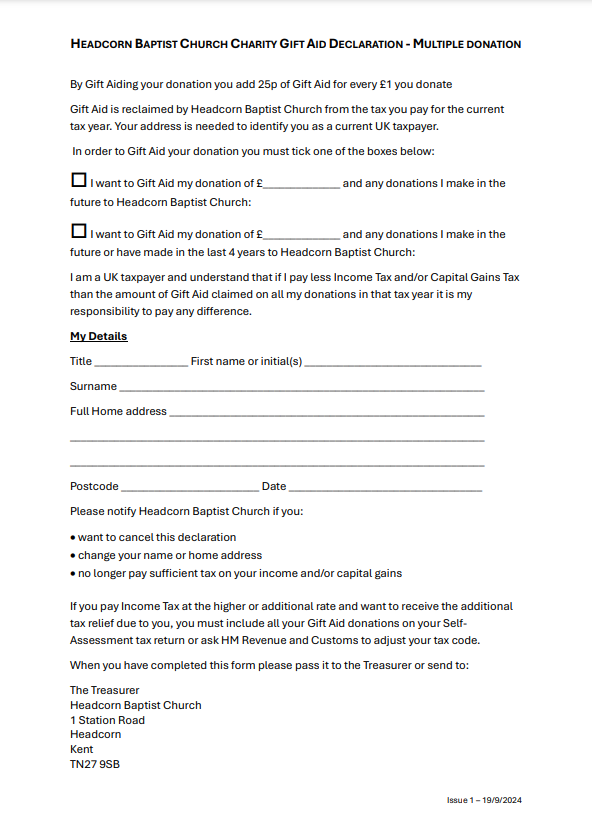

Gift Aid

Gift Aid helps us by adding 25p for every £1 you donate.

You must be a UK taxpayer and understand that if you pay less Income Tax and/or Capital Gains Tax than the amount of Gift Aid claimed on all donations in that tax year it is your responsibility to pay any difference.

Gift Aid is reclaimed by Headcorn Baptist Church from the tax you pay for the current tax year. For multiple/regular donations you further declare that you wish Headcorn Baptist Church to reclaim your current donation and any donations you make in the future or have made in the last 4 years.

If you pay Income Tax at the higher or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your Self-Assessment tax return or ask HM Revenue and Customs to adjust your tax code.

Your address is needed to identify you as a current UK taxpayer.

Please notify Headcorn Baptist Church if you:

- want to cancel this declaration

- change your name or home address

- no longer pay sufficient tax on your income and/or capital gains

Please ask for a gift aid declaration or download and complete the appropriate declaration and return it to us at:

treasurer@headcornbaptist.org.uk

The Treasurer

Headcorn Baptist Church

1 Station Road

Headcorn

Kent

TN27 9SB

| Single donation declaration | Multiple donations declaration |

|

|